Help Make It All Possible!

Be a part of the evolving legacy of the Shubert Theatre with a donation today that lays the foundation for the pivotal work we do onstage and in the community. We are committed to changing lives, amplifying voices, educating, inspiring, and creating a deeper connection to one another through the arts, and you make it all possible.

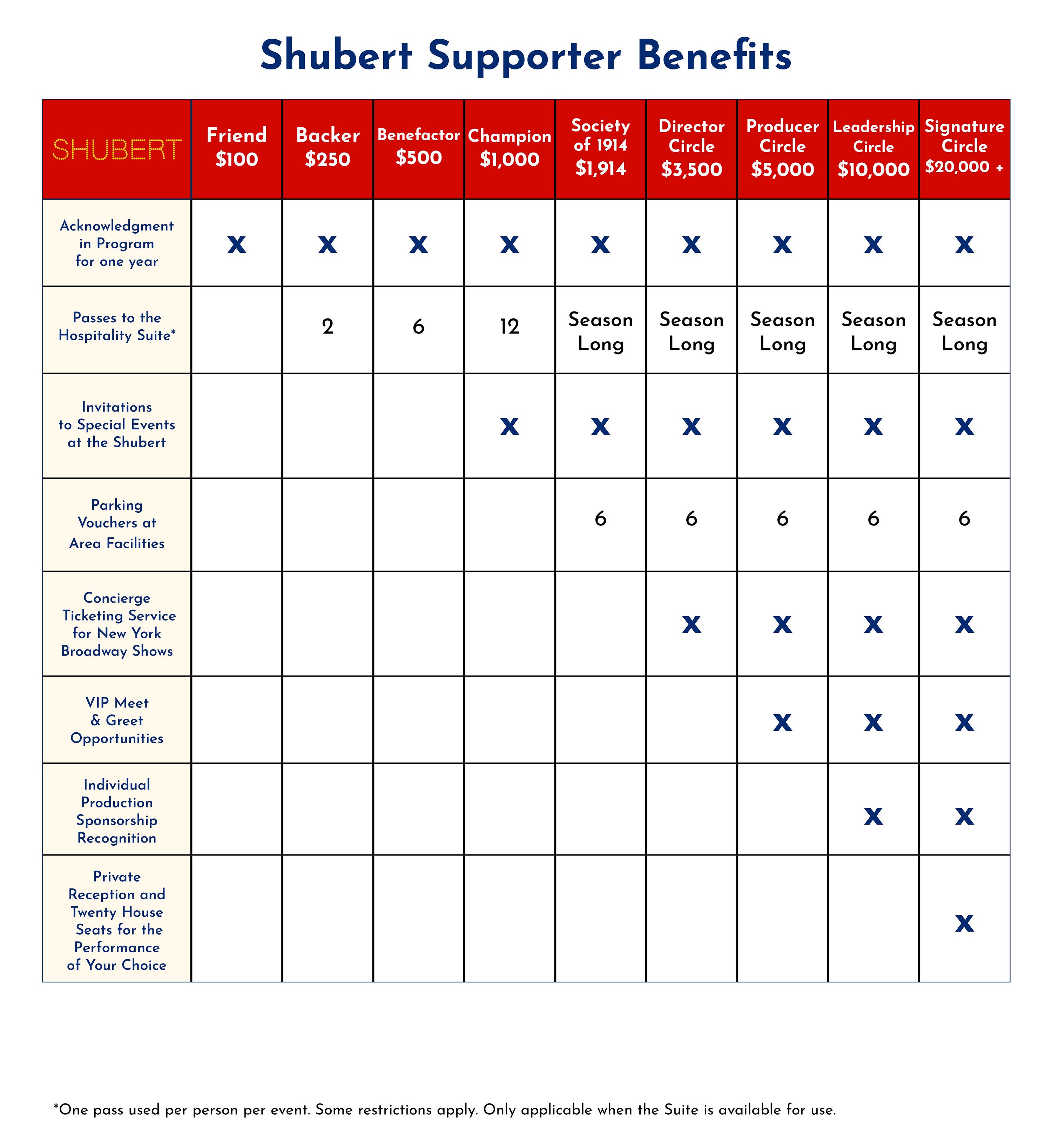

Shubert Theatre Giving Levels

- Friend: $100

- Backer: $250

- Benefactor: $500

- Champion: $1,000

- Society of 1914: $1,914

- Director Circle: $3,500

- Producer Circle: $5,000

- Leadership Circle: $10,000

- Signature Circle: $20,000+

Click Here For Donor Level Benefits

Be a part of the Shubert experience and join today!

- Donate Online

- Contribute by mail to:

- Shubert Theatre

Development Department

247 College Street

New Haven, Connecticut 06510

- Shubert Theatre

For additional information, or to make a donation over the phone, please contact Development Officer Angela Nietopski at 203-773-4338 | anietopski@capa.com.

Please make checks payable to CAPA/Shubert Theatre

Matching Gifts

Matching Gifts are a simple and effective way to double or even triple your gift. Simply enclose a completed form provided by your employer with your gift or pledge.

Planned Giving

Planned Giving

Planned giving ensures the future of this important historic and cultural asset and the presentation of the finest performing arts, vital education and community programs.

Through charitable estate planning, you and your family can support the Shubert Theatre while receiving financial and philanthropic benefits. Learn how you can keep this essential beacon in our community alive today, tomorrow and for generations to come in a manner that is consistent with your financial goals.

We hope that you will notify the Shubert of plans to include us in your estate plans to give us the opportunity to thank you and recognize your generosity.

The information on this website is not intended as legal or financial advice. The Shubert strongly encourages you to discuss this, and any, planned giving option with your attorney and/or financial advisor

The Gift of Securities

Donating long-term appreciated securities offers two rewarding benefits. You can deduct the present market value of your gift; in addition, you will owe no tax on the appreciation in value. If you have securities on which you have a loss, you could sell them and then donate the proceeds to the Shubert. The benefit for you is that your loss deduction will offset any gains in sales, and of course, you'll enjoy the emotional rewards of your charitable donation.

Keep in mind, 30 percent of your adjusted gross income is the limit on deductibility in any tax year -- any excess is deductible over the next five years.

Bequests

The greatest numbers of planned gifts made to charities are in the form of charitable bequests, which transfers assets upon a donor's death by means of a will or a trust.

Life Income Plans

A gift through a charitable gift annuity or charitable remainder trust will provide income to you and benefit the Shubert Theater.

Charitable Lead Trust

A gift through a lead trust will provide income to the Shubert during your lifetime while eventually passing assets on to your heirs.

Life Insurance or Retirement Plan Bequest

By designating the Shubert as a beneficiary of a life insurance or retirement plan when making a charitable bequest may offer significant tax savings to your estate.